If you’re comparing payroll providers, there’s a good chance you’ve looked at QuickBooks Payroll. It’s popular, especially if you already use QuickBooks for accounting. But convenience doesn't always mean it's the right fit—especially if you’re looking for hands-on support, ITIN worker compliance, or full-service payroll management.

At Baron Payroll, we hear the same thing from new clients again and again:

“We thought QuickBooks Payroll would be easier. But we ended up doing all the work ourselves.”

So how do the two actually compare?

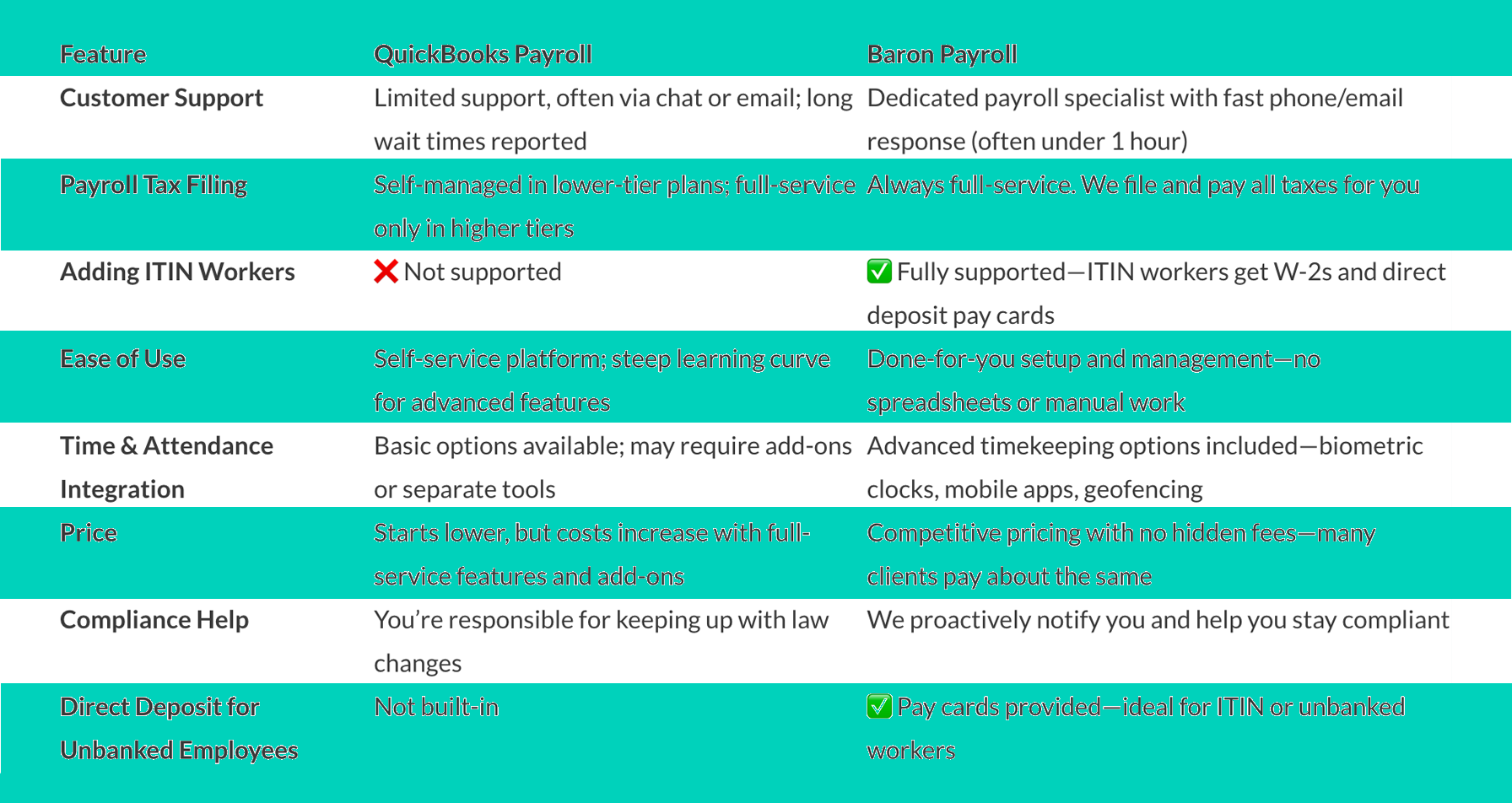

✅ QuickBooks Payroll vs. Baron Payroll: Side-by-Side Comparison

Which One is Right for You?

If you’re comfortable managing payroll yourself and don’t need ITIN support or hands-on service, QuickBooks Payroll may work.

But if you want:

-

A done-for-you payroll experience

-

A team that understands your industry and challenges

-

Support for ITIN workers, unbanked employees, and compliance…

Then Baron Payroll is a better fit.

Real Business Owner Quote:

“I waited 17 days to get a report from QuickBooks. With Baron, I get a response in under an hour.”

Ready to Make the Switch?

We make it easy.

Use our Instant Price Calculator to see how much it costs—no sales call required.

Are You Paying Too Much?

Send us your payroll invoice and get a FREE 10 min call to see if you’re getting ripped off.

Do you have ITIN workers?

Are you upset because your payroll company can't help?

How Much Does It Cost?

See detailed pricing now for each service without talking to a salesperson.