As a New York business owner, you probably have questions about the IT-2104 form. And you're not alone. The IT-2104 is a common topic of questions from New York businesses.

This article was designed to provide answers to the most common questions we get about the IT-2014 form.

In this article, you'll find:

- An introduction and overview to the IT-2104 and why it's needed for your New York Business

- Guidance and step-by-step instructions to ensure you fill out the IT-2104 properly

Let's go.

What is the IT-2104 Form?

New York State law requires each employee to fill out an IT-2104 form, so employers can withhold the correct amount of taxes from their paychecks.

The IT-2104 form is an essential document for New York employers when it comes to payroll administration. It is used to determine the amount of state income tax that should be withheld from each employee's paycheck.

This form, which is similar to a W4 for federal withholding taxes, provides information like filing status and allowances so that the right amount of taxes can be taken out of each paycheck.

Why Do I Need the IT-2104 Form?

It is important for employers to use the IT-2104 form when adding a new employee to your payroll, as it ensures that the correct amount of state income tax will be withheld from their earnings. Therefore, employers should provide this form to all new hires in order to comply with state tax regulations.

Are you familiar with the IT-2104 form? Are you using it for your payroll administration process?

If not, make sure to look into this important document as soon as possible. It is essential in order to ensure that your employees' taxes are being withheld correctly.

I Never Needed the IT-2104 Form Before; Why Do I Need it Now?

The recent changes to the W4 form have made it necessary for employers to also use the IT-2104 form.

This is because the information that was previously redundant between the two forms is now different, and employers need to ask for both sets of data in order to properly withhold taxes from each paycheck. Therefore, you should now require the IT-2104 form in order to ensure that you are withholding the right amount of state taxes from your employees' paychecks.

By using the IT-2104 form, you can be confident that your payroll administration process is compliant with state tax regulations and that all of your employees have the correct amount of taxes withheld from their earnings. So, ensure you look into this important document now and ensure your payroll process is up to date.

How Do My Employees Fill Out the IT-2104?

Filling out the IT-2104 form is actually quite simple. All you have to do is provide some basic information about yourself, including your name, address, and Social Security number. Then, you'll need to select what category best describes your financial situation. You can choose from a list of options such as single with no dependents, married with three kids, or self-employed.

In sections 3, 4, and 5, you can also input additional amounts that should be taken out of each paycheck. This feature is especially useful if you want to pay off any owed taxes ahead of time without having to worry about incurring late fees or interest.

Once you've filled out all the necessary information, you simply have to submit the form and wait for your new tax withholding rate to be applied. .png?width=2512&height=2112&name=MicrosoftTeams-image%20(10).png)

How Many Allowances Should My Employees Claim on the IT-2104?

The number of allowances an employee should claim on their IT-2104 form will depend on their individual financial situation. But in general, the more withholding allowances an employee claims, the lower their New York income tax deduction will be from each paycheck.

And in order to determine the best number of allowances for each employee, you should encourage them to talk to their accountants or at least use the IRS's withholding estimator. This tool can help them to estimate their tax obligation and determine the right number of allowances for them to claim.

It is important to note that while claiming more allowances may mean a lower tax deduction from each paycheck, it could also result in a larger amount owed at the end of the year. Therefore, be sure to inform your employees that they should use the withholding calculator regularly and adjust their allowances if necessary.

On the surface, these forms can seem complicated but don’t panic. We created a step-by-step guide to fill out the IT-2104.

Download Your Step-By-Step Guide

Download Your IT-2104 Guide

Fill out this form to receive your guide in your email.

The purpose of the IT-2104 is to instruct the employer (that’s you!) on how much New York State (and New York City and Yonkers) taxes they should withhold from their employee’s pay. The more allowances claimed, the lower the amount of tax will be withheld.

An IT-2104 form should be filled out every time your company hires a new employee. Filling out these forms properly can save you big headaches down the road come tax filing season.

There are many possible pitfalls to filling out withholding forms properly. For example, if you claim more than 14 allowances, you will have to fill out a withholding certificate affirmation.

Are You Paying Too Much?

Send us your payroll invoice and get a FREE 10 min call to see if you’re getting ripped off.

Do you have ITIN workers?

Are you upset because your payroll company can't help?

How Much Does It Cost?

See detailed pricing now for each service without talking to a salesperson.

New York IT-2104 Form, W-4 Withholding Form, & Withholding Certificate of Affirmation

- IT-2104 Employee's Withholding Allowance Certificate

- W-4 Employee's Withholding Certificate

- Withholding Certificate Affirmation

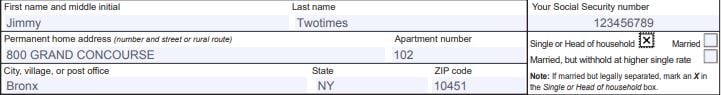

Page 1 Part 1 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 1 Part 1 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Step 1: On the first section of the first page (as shown above) enter the new employee’s information, including their first & last name, social, address, and whether they are single, filing single, or filing jointly with their spouse.

Page 1 Part 2 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 1 Part 2 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Step 2: In the next section (shown above) simply check whether you are a New York City resident, and whether you live in Yonkers, the 4th largest city in West Chester County.

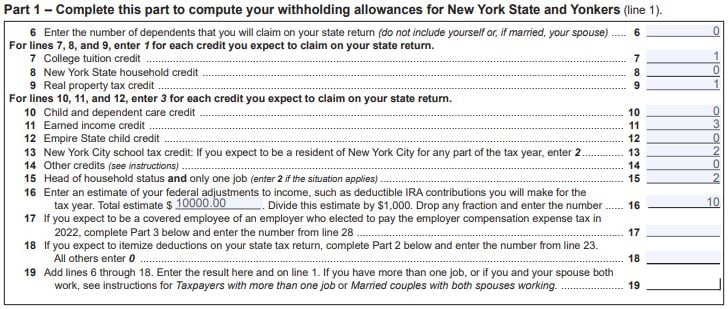

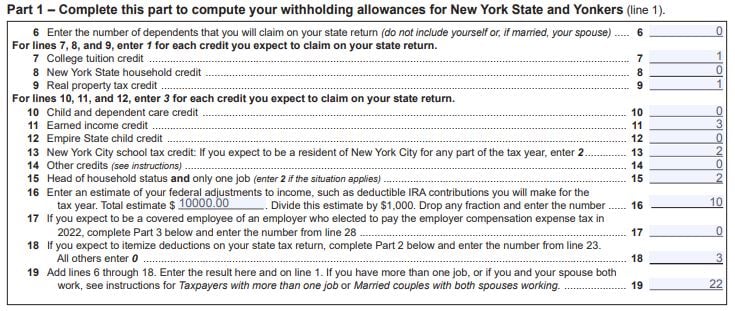

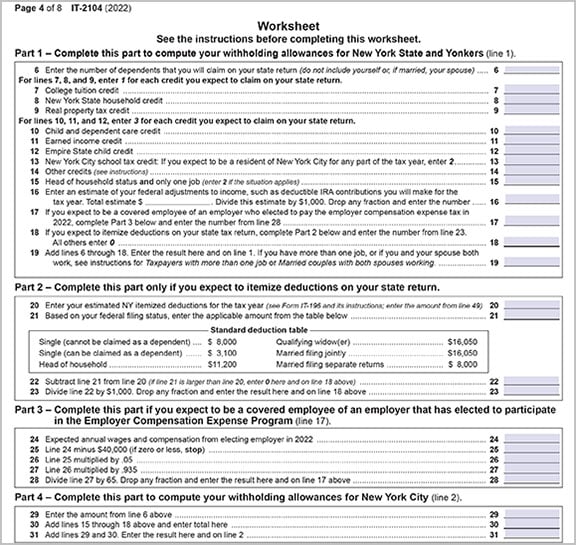

Page 4 Part 1 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 4 Part 1 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Step 3: Be sure you are on page 4 part 1 (shown above), as this will help fill out page 1, part 3 of the IT-2104.

- Line 6: Claim number of dependents. Be sure you DO NOT claim yourself or spouse as a dependent in line 6.

- Line 7: The college tuition credit is a New York tax credit where you can receive a maximum of $400 per student for tuition expenses. This can include you, your spouse, or any dependents you paid for. Put a 1 in line 7 for each student you plan to claim the credit for.

- Line 8: The New York State household credit can be claimed if you CANNOT be claimed as a dependent on anyone else’s taxes, are single and make $28,000 or less gross income, and/or you are married/filing jointly, and make $32,000 or less. If you qualify for this credit, add 1 to your total for line 8 for every dependent you have, plus yourself, and your spouse.

- Line 9: The Real Property Tax Credit reduces property tax burdens for qualified homeowners. To qualify, you must have in a prior year: lived in a school district that has complied with the New York State property tax cap, received either the basic or enhanced STAR exemption credit, had an income of $275,000 or less, AND paid school property taxes for the applicable year. If you meet all these qualifications, put a 1 in line 9.

- Line 10: The Child and Dependent Care Credit will compensate you if you paid for child care or the care of a dependent. You MUST have filed a federal and New York State 2021 tax return by April 18th, 2022 to claim this credit. The credit is worth up to $4,000 for one dependent, or $8,000 for two or more. If you qualify, put 3 in line 10.

- Line 11: Earned Income Credit is a federal, state, and New York City tax credit for families, parents, and even singles who work full-time, part-time, or are self-employed. Check here to see if you qualify. If you do, put 3 in line 11.

- Line 12: The Empire State child credit is a refundable credit for full-year New York residents with children that are at least 4 years of age, and who qualify for the Federal Child Tax Credit. See if you qualify here. If you do, put a 3 in line 12.

- Line 13: The New York City School tax credit is for any New York City residents that aren’t claimed as dependents on another taxpayer’s form. You must also make $250,000 or less to qualify. If you do qualify, put a 3 in line 13.

- Line 14: For additional credits. Put 0, unless you think you have additional credits, then follow instructions in the worksheet.

- Line 15: If you are the head of the household and only have a single job, put 2, otherwise, put 0.

- Line 16: Here you estimate what your federal adjustments to income will be. Adjustments can include alimony payments, contributions to your retirement fund, and student loan interest. Divide the estimated adjustment by 1,000, and put the resulting number in line 16.

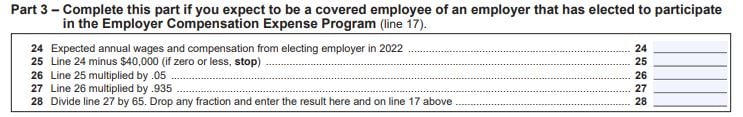

Page 4 Part 3 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 4 Part 3 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Step 4: If your employer participates in the Employer Compensation Expense Program, you have to fill out lines 24-28 to complete line 17.

- Line 24: Put your expected yearly earnings from your participating employer in this line.

- Line 25: Subtract $40,000 from your expected wages and put the remainder in this line. If it is zero or less, put 0 for lines 25-28.

- Line 26: Multiply the value from line 25 by .05, put that number in this line.

- Line 27: Multiply value from line 26 by .935

- Line 28: Divide line 27 by 65. Drop and fraction and enter the result on this line, and on line 17.

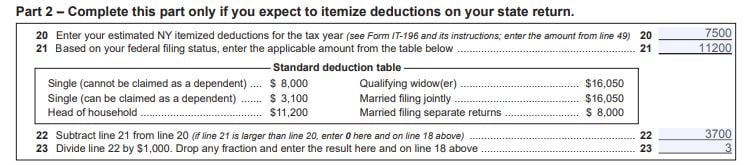

Page 4 Part 2 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 4 Part 2 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Step 5: This step is ONLY necessary if you expect to have itemized deductions on your state return.

- Line 20: Put your estimated state itemized deduction for the year.

- Line 21: Depending on your filing status, there is a standard deduction amount. Enter that amount with the table provided above.

- Line 22: Subtract line 21 from 20. If this gives you a negative number, put 0 instead, as this calculates your deductions beyond the standard amount. Put 0 in line 18 as well. If your answer for line 22 is zero, you do not need to complete line 23.

- Line 23: Divide the amount from line 22 by 1,000, only keeping the remaining whole number (no decimals). Put the resulting number in this line, as well as line 18.

Page 4 Part 1 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 4 Part 1 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Step 6: Now for the fun part. Go back to part 1 of page 4 (as shown above) and add lines 6 – 18. Put the sum of all those numbers into line 19. Don’t celebrate just yet though, we are not finished. If you are married, and you and your spouse both work, check your withholding amount before proceeding to the next step.

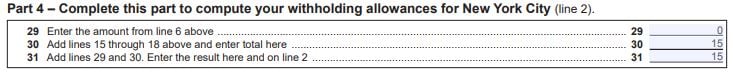

Page 4 Part 4 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 4 Part 4 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Step 7: This step will determine your withholding allowances for New York City.

- Line 29: Enter the amount from line 6 of page 4, part 1.

- Line 30: Add lines 15-18 from page 4, part 1. Put the sum in this line.

- Line 31: Add line 29 & 30. Put the sum in this line, and line 2 on page 1, part 2.

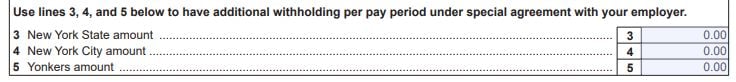

Page 1 Part 3 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 1 Part 3 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Step 8: Here you can elect to have additional withholdings every pay period for an amount agreed upon with your employer.

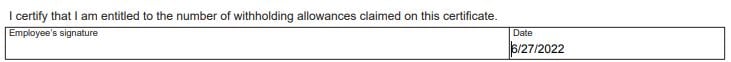

Page 1 Part 4 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 1 Part 4 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Step 9: Now for the easy part. Sign and date it. If Jimmy can do it, anyone can.

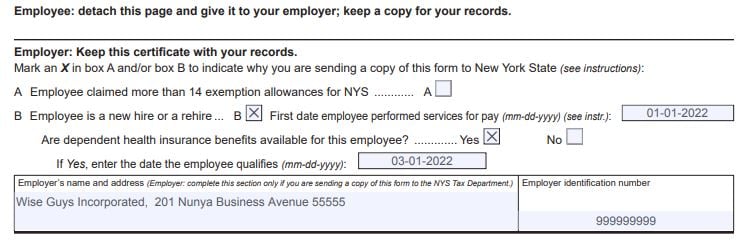

Page 1 Part 5 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 1 Part 5 - 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Step 10: The good news is, if you are an employee, you can leave this section for your employer. If you are a business filling this out for an employee however, then you will need to check whether they claimed more than 14 exemptions. If they have, they will have to fill out a withholding certificate of affirmation. Note that whether they are a completely new hire, or have been hired before, they still should fill out an IT-2104.

Be sure to include the employee’s starting date, as well as if they get health benefits, and when they will be eligible for them.

The final step (yes we are finally here) is to put your company’s name, address, and Employer Identification Number.

That’s it! You did it! Congratulations. Still have some questions/concerns? Check out our FAQ below.

How Can I Make Sure My IT-2104 Withholding Allowances are Correct?

The IT-2104 Worksheet is designed to help you improve your withholding allowance accuracy. Simply follow the Worksheet guidelines. The goal is to not under or over withhold income taxes from your employee wages in New York State, New York City, and Yonkers.

Page 4 – Worksheet for the 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

Page 4 – Worksheet for the 2022 New York State Employee’s Withholding Allowance Certificate IT-2104

What Happens if the Employee Doesn’t Fill Out the IT-2104 Form?

Then the employer will withhold single with zero allowances. The reason for this is that it will result in the most taxes withheld and prevent the employer from getting in trouble for not withholding enough New York State taxes.

What are the Different Types of IT-2104 Forms?

There are several different types of IT-2104 forms for the 2021-2022 tax periods. Most people will use the IT-2104 Employee’s Withholding Allowance Certificate.

Other types of IT-2104 forms are:

- IT-2104-E Certificate of Exemption from Withholding

- IT-2104-IND New York State Withholding Exemption from Withholding for Native Americans

- IT-2104-MS New York State Withholding Exemption Certificate for Military Service Personnel

- IT-2104-P Annuitant's Request for Income Tax Withholding (An annuitant is an individual who is entitled to collect the regular payments of a pension or an annuity investment.)

- IT-2104-SNY Certificate of Exemption from Withholding for START-UP NY Program

- IT-2104.1 New York State, City of New York, and City of Yonkers Certificate of Nonresidence and Allocation of Withholding Tax

What is the Difference Between the W-4 and IT-2104 Forms?

The W-4 is for withholding federal income tax, and the IT-2104 is for withholding New York State income tax.

Why Do I Now Have to Submit Both the W-4 and the IT-2104 Forms?

Both forms are needed due to the W-4 redesign. Prior to the redesign, the forms mimicked each other and contained the same information. To withhold state tax correctly, the IT-2104 answers questions such as marital status, number of allowances/exemptions, and more. Without this vital information, employees will have too much, or too little withheld from their paychecks.

Why Did the IRS Redesign the W-4 Form?

Two major reasons the form was redesigned were to accommodate people with multiple jobs and people with other non-job incomes.

Check out this video titled Drastically Different W4 for 2021 to learn more:

Are All Employees Required to Furnish the Redesigned W-4 Form?

Good question. People often assume that because the W-4 form was redesigned, they must now submit the new form. Fortunately, employees who have furnished the W-4 form prior to 2020 don’t have to supply the new form. However, it’s important to note that every time an employee switches jobs, a new W-4 must be submitted.

Staying Compliant with New York Labor Forms and Regulations is Exhausting

We hear that every day. Making sure your W-4 and IT-2104 forms, are up to date, properly filled out, and submitted correctly is important to the welfare of your employees, and your business.

Staying on top of all the new regulations is time-consuming, and stressful. Fortunately, payroll companies such as ours, Baron Payroll, are IRS and New York State compliance experts. We think of every new form and regulation as clouds with silver linings. Our passion is finding these silver linings, and helping your business make the most of them.