We know that handling payroll can get pretty overwhelming, especially when it comes to understanding payroll service charges.

Sometimes your invoice can be hard to read because everything is bundled and not broken up.

Do you really need everything you’re paying for?

What the hell are all of these fees and services?

Let’s take a look because you may not need them all.

In this article, we're going to dive into what you’re paying for and what to do if you’re paying for services you don’t need.

Understanding Payroll Company Charges

Here are a few factors that influence how they determine payroll companies charge:

Employee Count: The more employees you have, the more you'll pay. It's like a "per-employee" deal, where the number of employees you've got directly impacts the cost. So, the bigger your team, the bigger the charges.

Payroll Frequency: How often you run payroll plays a part too. Whether you do it weekly, bi-weekly, or monthly affects the pricing structure. If you're running payroll more frequently, it might mean a higher cost.

Services Required: Payroll companies offer a bunch of services, like processing payroll, tax filings, direct deposit, and benefits administration. The more comprehensive the services you need, the higher the cost will likely be. It's like going for the full package at a spa — you get more services, but it comes with a higher price tag.

Additional Features: Some payroll companies provide extra bells and whistles, like time tracking, HR management, and employee self-service portals. These fancy features might come at an additional cost, so keep that in mind when choosing your package.

Payroll Complexity: If your business has some unique payroll requirements, such as multiple locations, various pay rates, or custom reporting, things can get a bit more complex. And, you guessed it, that complexity can sometimes mean extra charges.

Do You Understand the Services You’re Paying for?

One of the reasons why business owners find it hard to understand their payroll service invoice is that they don't understand the services they're paying for.

And once you understand your services, you can talk to your payroll company and have an informed conversation.

The thing about most payroll companies is that they bundle their services to make pricing "easier"...

This means that you're buying a package of services rather than an itemized list with charges.

For example, if you’re paying for background checks that you don’t need, it could increase your payroll cost significantly.

How to Read Your Payroll Service Invoice

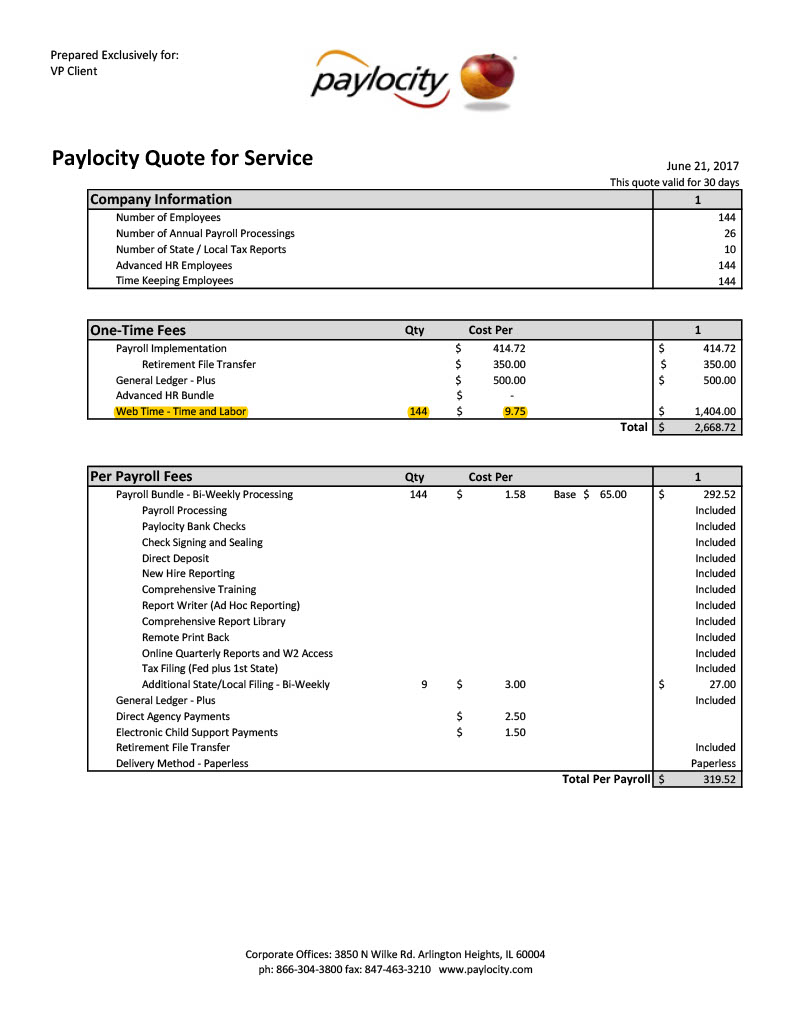

Now, let's take a look at the dreaded payroll service invoice.

Here are the main things you should look for:

Basic Service Fee: This is the regular fee for the payroll company's services. It's usually a recurring monthly or per-payroll charge. Think of it like the foundation of your invoice.

Per-Employee Fee: Payroll companies often charge a fee for each employee on your payroll. So, the more team members you've got, the more you'll see those charges adding up. It's like paying a little something for each person to join the payroll party.

Additional Service Charges: Did you opt for some cool add-on services? Things like time tracking, HR management, or benefits administration might come with separate charges. It's like ordering extra toppings on your pizza – they come at an extra cost, but they can be totally worth it.

Tax Filing and Compliance Fees: Payroll companies handle tax filings and ensure you're compliant with employment laws. That kind of service often comes with fees to cover those tasks. It's there to make sure you don't mess up your taxes.

Direct Deposit Fee: If you offer direct deposit to your employees, there might be a fee for that service. It covers the costs of electronically transferring those hard-earned funds. Think of it like a small convenience fee for skipping the check-writing hassle.

Setup or Onboarding Fee: Some payroll companies charge a one-time fee for getting your account set up or onboarding your organization onto their system. It's like paying for the red carpet treatment when you first sign up.

Ancillary Fees: Oh, those miscellaneous charges! You might find fees for things like check printing and delivery, custom report generation, or support for special requests. It's like those little surprises that pop up on your invoice – they're unique and unexpected.

Have You Compared Invoices?

There are a ton of payroll service providers in the market, and comparing their prices and services could help you save on costs.

For example, a small payroll company might provide you with an itemized invoice that's easier to understand.

And a bigger service provider might have bundled services that you might not be using.

.png?width=791&height=1024&name=MicrosoftTeams-image%20(55).png)

By the way, if you need help reviewing your invoice, we’re here for that.

Get a Free Review

Baron Payroll offers a free review of your invoice.

All you need to do is upload your payroll service invoice, and our team of experts will help you understand if you’re overpaying for your services.

Are you paying too much for your services?

Upload your invoice for free and we will give you a call to go over it together.

What Do You Do if You’re Paying for Services You’re Not Using?

One of the best things about Baron Payroll is that we allow our clients to pick and choose the services they need.

We don't have package deals or hidden fees, ensuring that our clients only pay for the services that they require. Our pricing is transparent, and we provide our clients with itemized invoices that are easy to understand.

By working with us, you can rest assured that you won't be paying for services you don't need or want.

Not sure what services you need?

Take our quick services quiz to find out!

And that’s it!

Now you have a better grasp of how payroll companies determine their charges and how to read your payroll service invoice.

And by knowing the services you're paying for, comparing invoices, and picking and choosing what you need, you can save on costs and ensure that you're paying for only the services you require.

If you're unsure about your invoice, fill out the form for a free review to help you understand your charges and ensure that you're getting the best value for your money.

If you found this article helpful, here are some others you might like:

- How Much Do Payroll Services Cost?

- 1099 vs W2 Employee - An Honest Cost Comparison for Business Owners

- Why are my W2 Wages Lower Than my Salary?

- How to Choose the Best Payroll Company for Your Small Business

- The Pros and Cons of Paying Employees with Payroll Paycards

Are You Paying Too Much?

Send us your payroll invoice and get a FREE 10 min call to see if you’re getting ripped off.

Do you have ITIN workers?

Are you upset because your payroll company can't help?

How Much Does It Cost?

See detailed pricing now for each service without talking to a salesperson.