Do you know that your employee’s paychecks can be stolen without your knowledge? It sounds like a nightmare, but it is a very real threat. Every month, businesses nationwide fall victim to this direct deposit scam (otherwise known as direct deposit diversion fraud) and lose their hard-earn money.

So, What is Direct Deposit Diversion Fraud?

This type of fraud is when a cybercriminal steals employee information, such as name and email address, and then uses that information to change the destination of their direct deposit from the legitimate account to an account in the criminal’s name. On payday, businesses think they are paying their employees but instead are unknowingly paying criminals.

How Does this Happen?

It’s not as difficult as you might think. For a security breach, all the criminal needs is employee information and access to a company’s payroll system.

This information can be easily obtained from the company website, emails, or by looking the person up on social media and checking their Facebook page or LinkedIn profile. Then the criminal phishes by pretending to be an employee and sending a request to change their direct deposit bank account.

Once the account is changed, the money is transferred to the criminal’s account and it is virtually impossible for businesses to get their money back.

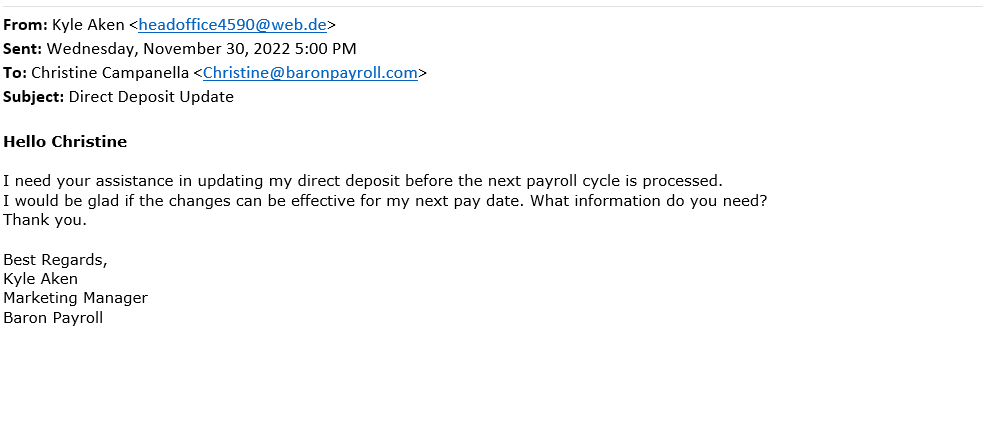

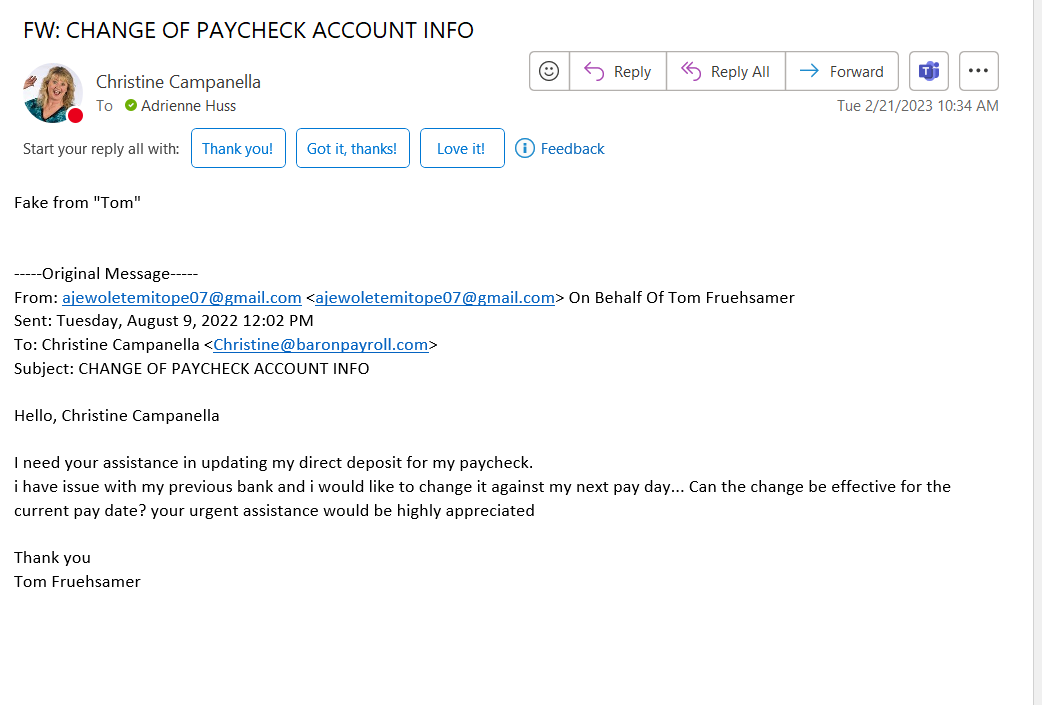

Here are examples of real emails that our company received from scammers, posing as employees:

How Can You Protect Your Business?

The best way to protect your business is to ensure that all requests for direct deposit changes are legitimate. Unless the employee hands you a direct deposit bank account change in person, you must go the extra mile and make a phone call and speak with your employee, every time, to verify that the request you received by email is real.

This may seem like a hassle, but it is much easier than dealing with the repercussions of unwittingly paying thieves.

It’s important to remember that you and your employees are not powerless against direct deposit fraud. By taking the necessary precautions and properly verifying all requests for direct deposit changes, you can significantly reduce your risk of becoming a victim of this type of fraud.

At the end of the day, it’s up to you to protect your business and your employees from direct deposit fraud. Taking a few extra steps to verify requests for direct deposit changes will help ensure that paychecks are going where they should—straight into the hands of your employees.

Are You Paying Too Much?

Send us your payroll invoice and get a FREE 10 min call to see if you’re getting ripped off.

Do you have ITIN workers?

Are you upset because your payroll company can't help?

How Much Does It Cost?

See detailed pricing now for each service without talking to a salesperson.

If you found this article helpful, here are some others you might like:

- Why are my W2 Wages Lower Than my Salary?

- How to Choose the Best Payroll Company for Your Small Business

- The Pros and Cons of Paying Employees with Payroll Paycards

- Why Employee Printback Checks are Good for Your Business

- How Will the New York State Secure Choice Retirement Savings Program Impact Your Business